A Fortune 500 insurance provider partnered with Apromore to transform its auto claims processing, addressing challenges like inefficient manual processes, lack of transparency, and compliance risks. This led to delays that negatively impacted customer experience and regulatory adherence.

With Apromore’s process mining platform, the provider gained visibility into the claims process, identifying bottlenecks and inefficiencies. Automation tools ensured compliance by monitoring regulatory timelines, while predictive dashboards provided early warnings on potential delays, facilitating proactive interventions.

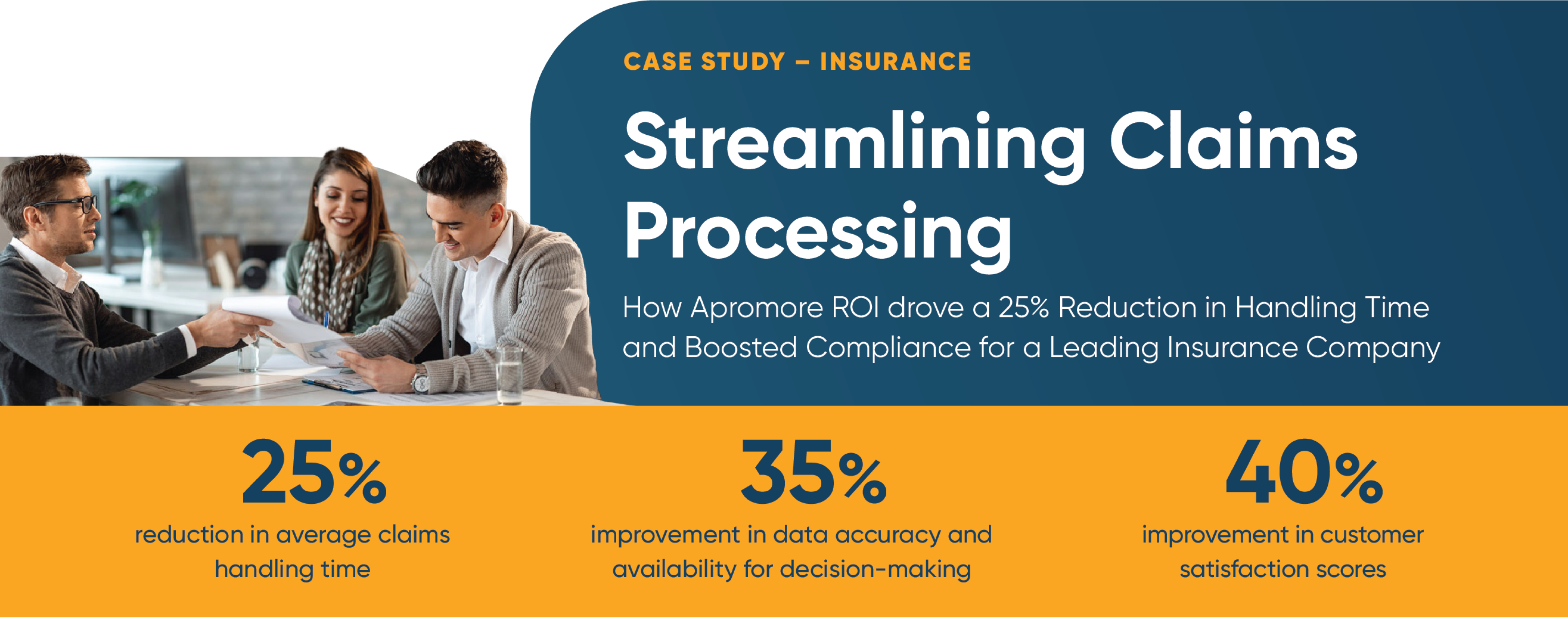

As a result, claims handling and compliance improved significantly, leading to enhanced customer satisfaction through reduced delays and complaints. By automating critical steps and leveraging data-driven insights, the provider achieved operational excellence in a highly regulated industry.